June ends, but with a little more activity than usual as in two sells followed by to buys. However first, the overall situation.

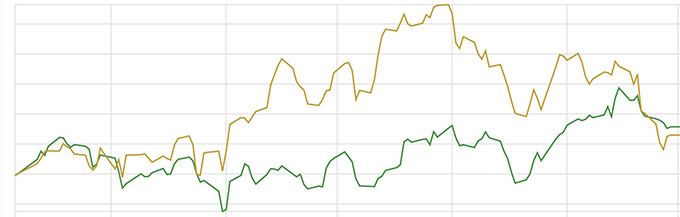

For the month of June the portfolio was up a little over 3%, this compares to an increase of just under 2% by the FT All World Index, and a fall over -1% by the FTSE 100 index. So a rather pleasant portfolio monthly gain while nicely out performing the benchmark indices I like to compare it to. Biggest gainer was the Franklin India Fund, up 8%, followed by the Legal & General Global 100 Index Trust, up over 6%.

So, if things are so good, why some changes, especially as none of them had met my basic sell criteria of cutting down through my monthly moving averages? It was when I looked at my various Global-type funds I saw there were too many of them invested into the same relatively few companies as their main holdings, Apple, Microsoft, NVIDIA, Alphabet etc. The idea behind this portfolio is to have a reasonably diverse range of investments and not putting all my proverbial eggs into one basket. Diversification may mean I’ll miss out on the stellar gains made by any one individual company, but then should be protected as best I can from individual dramatic falls.

So out went the BlackRock Global Unconstrained Equity and also Invesco Global Focused Fund. Their replacements, one ‘sensible’, but balanced out by one a little more high risk. First, the more sensible one; Ninety One UK Special Situations Fund. This fund gives access to a range of medium to large size UK companies like Rolls Royce, Verity, and NatWest Group. As I didn’t have anything specific to the UK (which, despite everything, is one of the larger world economic countries) this seemed a sensible addition to the portfolio.

The other, more high risk, is the HSBC Global Investment Fund (GIF) Turkey Equity Fund. Not an obvious choice for me, and regardless of your views of its rather controversial leader, Recep Erdogan, the country’s economy has being doing rather well over the last few years (it was one of the few countries able to expand its economy during the 2022 COVID period). A population now over 85 million and with a growing GDP I’ll do a little bit of ‘nothing ventured, nothing gained’, however this one will need watching quite carefully.

So this now gives me a selection of global-targeted funds with the rest spread across America, Emerging Markets, India, Japan, Turkey, the UK, Finance and Technology (and with the Globals now covering a less concentrated range of investments).

Fidelity Global Industrials Fund

Franklin India Fund

Fundsmith Equity (global)

GQG Partners Emerging Markets Equity Fund Class

HSBC Global Investment Funds – Turkey Equity

JupiterMerian Global Equity Absolute Return Fund

Legal & General Global 100 Index Trust

Man GLG Japan CoreAlpha Equity

Ninety One American Franchise Fund

Ninety One UK Special Situations Fund

Pictet – RoboticsI (technology)

Polar Capital Global Insurance Fund (finance)

Leave a comment