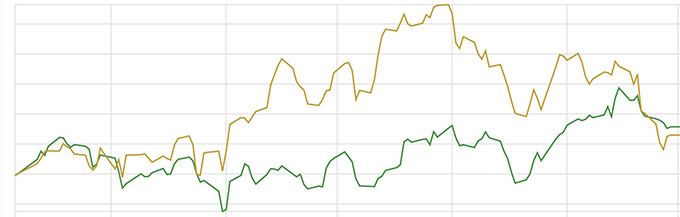

For the first 10 days of May things generally looked quite nice. However what goes up often falls down, and so it was to be for the month with my portfolio finishing with an overall (just) negative result. Not a huge loss, down by -0.2%, but still into negative territory.

Generally this would not disappoint me to much but it should be compared to a gain of approximately 1.6% by my local index, the FTSE100, and an even bigger gain by the F.T. All World index of just under 3.2%. So relative to these indices not a good month for me.

Best portfolio performer, Legal & General Global 100, up just over 3.5%; worst being Franklin India, down just over 2.5%, with everything else spread fairly evenly between these two (but with an overall negative edge). So nothing too dramatic and nothing on the immediate sell list.

Hopefully, now that the election is over in India and any electoral uncertainty should have gone we might see a bit of recovery there. If there’s one thing the stockmarket hates and that’s uncertainty. Good news is nice, bad news can be worked around, but uncertainty is so disruptive. On the other hand these things will do what-ever they’re going to do and I must just work my way around this.

BlackRock Global Unconstrained Equity Fund

Fidelity Global Industrials Fund

Franklin India Fund

Fundsmith Equity

GQG Partners Emerging Markets Equity Fund

Invesco Global Focus Fund

JupiterMerian Global Equity Absolute Return Fund

Legal & General Global 100 Index Trust

Man GLG Japan CoreAlpha Equity

Ninety One American Franchise Fund

Pictet RoboticsI

Polar Capital Global Insurance Fund

Leave a comment