This portfolio I’ve been running is now hitting its one year mark. Although this may be a pretend / virtual one it is based upon the activities within my actual pension fund. The differences being that this is only one year old where my pension fund has been running for some time, and when I started this virtual one I started by giving each of the investments equal weighting, where my real pension fund has varying amounts across the investments.

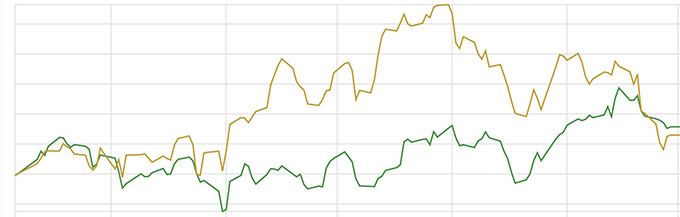

So how’s it done over the last 12 months? For the first 6 months, rather indifferent, but then a nice pick-up from November through to today (start of April 2024).

Overall this portfolio (see below) is up 18.4%, the FT All World up 20.9%, the FTSE 100 up just under 4.2%.

So not quite as good as if I’d just put it into an all world tracker fund (though still competitive, plus out performing inflation) while beating the pants off my more local FTSE 100 performance. Happy enough with this.

Things learnt; don’t trade too often, but this must be balanced against cutting your losses when you see things falling. A little reminder on this. If something falls by say 25%, so from a value of 100 down to 75, to get that 75 back up to 100 you must increase it by 33.3%. Or a 50% fall from 100 to 50 will require to double that 50 to get back to 100 – so much harder to do. Never a bad thing to cut losses, they’re so much harder to recover from.

Current holdings:-

BlackRock Global Unconstrained Equity Fund

Fidelity Global Industrials Fund

Franklin India Fund

Fundsmith Equity

GQG Partners Emerging Markets Equity Fund

Invesco Global Focus Fund

JupiterMerian Global Equity Absolute Return Fund

Legal & General Global 100 Index Trust

Man GLG Japan CoreAlpha Equity

Ninety One American Franchise Fund

Pictet RoboticsI

Polar Capital Global Insurance Fund

Leave a comment