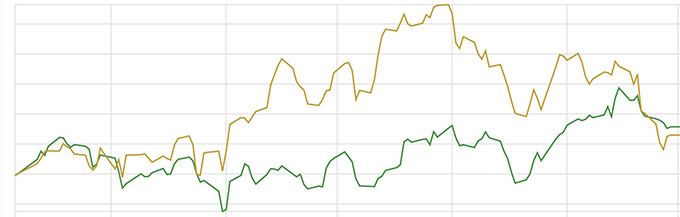

A pleasantly nice month for February. The portfolio showed an investment gain of just over 4%, nicely matching the FT All World index and outperforming the FTSE 100 Index (which ended up at almost the same level at the end of the month compared to the start).

Biggest gainer for the month was Invesco Global Focus with a growth of just under 8%, with none of the others showing a loss.

There was one trade during the month. My Polar Capital European ex-UK went and was replaced with Pictet Robotics. It’s not that PC European ex-UK was doing particularly badly but it was moving sideways enough for the various moving averages I watch to catch up with it, so time it went. This was replaced with Pictet Robotics which, as its name implies, invests in companies that are involved in the robotics, automation, data processing, and other supportive industries. Since inception (2016) it’s given an average annual rate of return of just over 20%. Considering this includes COVID and the outbreak of war in Ukraine I’m happy with this.

BlackRock Global Unconstrained Equity Fund

Fidelity Global Industrials Fund

Franklin India Fund

Fundsmith Equity

GQG Partners Emerging Markets Equity Fund

Invesco Global Focus Fund

JupiterMerian Global Equity Absolute Return Fund

Legal & General Global 100 Index Trust

Man GLG Japan CoreAlpha Equity

Ninety One American Franchise Fund

Pictet Robotics

Polar Capital Global Insurance Fund

Leave a comment