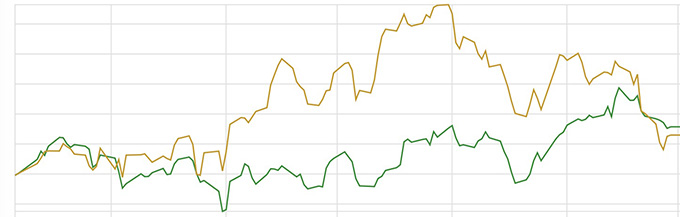

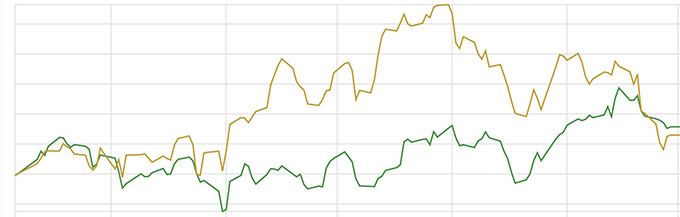

Over September the portfolio was up just under 0.5%, however this is compared to the Financial Times All World Index (AW01) which was down just over -4% for the month. So this 0.5% may only be a small gain but relative to the market it’s not too bad a performance. (The FTSE 100 index was up just over 2%, but the slightly odd thing being that the UK indices were the only major world indies to be in positive territory for September.)

Two sell / buy transactions happened during September; at the start of the month Artemis Strategic Assets went having got itself into a gentle downtrend and falling through the 10 and 20 week moving averages, and was replaced with Ninety One American Franchise Fund; and right at the end of the month Comgest Growth Europe went having substantially fallen through the 40 week / 200 day moving average, and replaced with GQG Partners Emerging Markets Equity Fund.

So what’s happened over the last 6 months?, For the first 4 months the portfolio just trundled along and under-performed relative to the All World Index. However from August the All World has gone through a bit of a downer while my portfolio has perked up to bring it up above the All World. So a AW01 six month gain of around 1.7% and my portfolio up an additional 1%. (Over this 6 months the FTSE 100 was down a little less than -1%.)

FTSE All World, yellow; and Portfolio, green.

From April 2023 to end of Sept 2023.

Biggest gainers have been the Man GL Japan Core Alpha (up over 28%) and the Franklin India fund (up over 17%). Biggest loss from the Barings Global Agriculture (-8%) and the recently sold Comgest (just over -5%). Most of the other sells (following my guidelines of selling once the price falls through a mix of the 10, 20 & 40 week moving averages) were also around the -4% to -5% level. So these relatively small loss sells rather dragging down my nice gains from Japan and India.

However there is one huge big question; are my guidelines for selling too strict. It’s so important to cut one’s losses, a reminder that to recover from a 10% fall you must have a recovery of 11%, from a 25% fall a 33.3% recovery, and for a 50% fall then double your investment value to get back to where you were!

Had I ignored my guidelines and not sold anything then I would be showing a 6 month gain of a little over 7%! So many of those that fell and triggered my cut-off then recovered and moved back into positive territory. Grrrr….

I still want some sort of guide to get me to sell so minimise losses, but I’m thinking about changing my 10, 20 & 40 weekly moving average to a longer monthly ones, and looking at it over a 12 or 18 month moving average time period. That should cut out the more short term noise.

Let’s see what happens, this is all part of the learning experience.

Current holdings:-

BlackRock Global Unconstrained Equity Fund

Fidelity Funds – Global Industrials Fund

Franklin India Fund

Fundsmith Equity

GQG Partners Emerging Markets Equity Fund

Invesco Global Focus Fund

JupiterMerian Global Equity Absolute Return Fund

Legal & General Global 100 Index Trust

Man GLG Japan CoreAlpha Equity

Ninety One American Franchise Fund

Polar Capital European Ex UK Income Fund

Polar Capital Global Insurance Fund

Leave a comment