How was August?

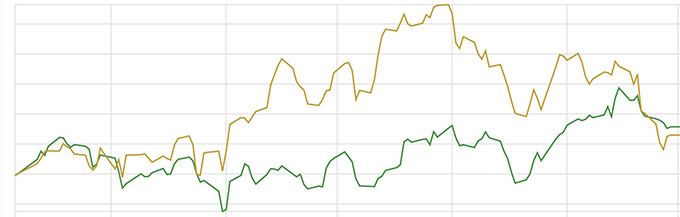

I guess it boils down to whether you’re a glass half full or glass half empty person. So, first the bad news. August ended up being a negative month, the portfolio down by less than one quarter of one percent, but even though that’s almost at rounding error level it’s still a negative result. As for the glass half full view, although my portfolio had gone into negative territory the FTSE 100 index had fallen by around -3.3% and the FT All World Index down by around -2.8%, so at least I’d managed to outperform much of the rest of the world.

Since inception, the one standout performer has been the Japanese holding followed by India, with all the rest muddling along behind. Speaking of which, my Artemis Strategic Assets is on the disposal watch list. At the start of this portfolio it gave a nice gain, but has fallen off its peak and is now cutting below the 10 and 20 week moving averages which I use as my guide. So if it’s not doing very much and I can see something doing much nicer, then time for a swap? We’ll just have to wait and see, but I’m not waiting for too long.

The start of next month (October) represents six months of this experiment, so perhaps a review of how individual investments have performed.

Artemis Strategic Assets Fund

BlackRock Global Unconstrained Equity

Comgest Growth Europe ex UK

Fidelity Funds – Global Industrials Fund

Franklin India Fund

Fundsmith Equity

Invesco Global Focus Fund

JupiterMerian Global Equity Absolute Return Fund

Legal & General Global 100 Index Trust

Man GLG Japan CoreAlpha Equity Fund

Polar Capital Funds PLC – Polar Capital European Ex UK Income Fund

Polar Capital Funds PLC – Polar Capital Global Insurance Fund

Leave a comment