So what about July.

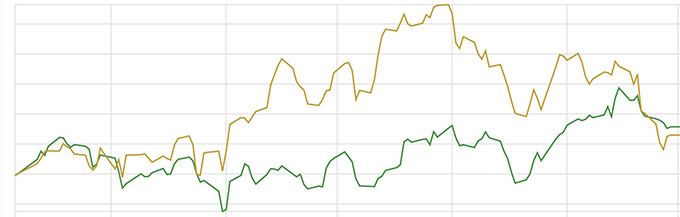

Portfolio growth of just over 1% through the month. Not a stunning gain, but better a small gain than any sort of loss!

One trade, the Fidelity FAST Global Fund had cut down through my moving averages enough to warrant a sell, so off it went. As these things happen, a few days after the sell it bounced back up. No point in getting annoyed with things like this, the idea of having some basic rules is to protect you from nasty losses even if it means losing out at times.

Replacing the Fidelity fund was the Legal & General Global 100 Index Trust. As its name implies, it’s designed to track the S&P Global 100 index by investing in 100 of the largest companies across the world. It should provide a reasonable level of stability and (hopefully) sound long term growth.

On a more positive note, the biggest gainers are Franklin India and Man GLG Japan. Related to this I’m keeping a general eye on one or two of the Vietnam funds. Asia (other than perhaps China) seems to be doing quite well at the moment.

As for the rest, the Polar Capital European and the Polar Capital Global Insurance funds which had been looking a bit weak seem to be perking up now, so overall there’s nothing I’m too worried about at the moment.

Current portfolio now consists of:-

Artemis Strategic Assets Fund

BlackRock Global Unconstrained Equity

Comgest Growth Europe ex UK

Fidelity Funds – Global Industrials Fund

Franklin India Fund

Fundsmith Equity

Invesco Global Focus Fund

JupiterMerian Global Equity Absolute Return Fund

Legal & General Global 100 Index Trust

Man GLG Japan CoreAlpha Equity Fund

Polar Capital Funds PLC – Polar Capital European Ex UK Income Fund

Polar Capital Funds PLC – Polar Capital Global Insurance Fund

Leave a comment