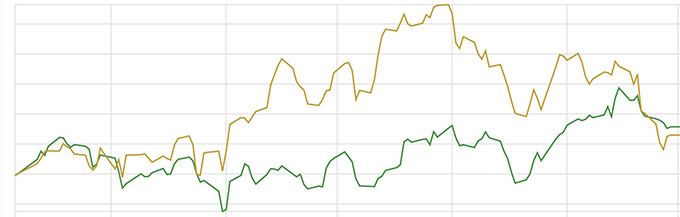

So, whats happened for June. The FT All World index was up by around 5% while my portfolio was up around 2%. Always nice to have a bit of a gain, though mildly disappointed not to be at least matching my All World benchmark index.

Sticking with my (moderately flexible) rule of selling when prices drop below their 40 week / 200 day moving average, (and buying those that show a reasonably consistent growth over the last 12 to 18 months), Legal & General Global Health, Guinness Global Energy and Barings Global Resources went, and were replaced by Invesco Global Focus, BlackRock Global Unconstrained Equity and Comgest Growth Europe. All three of these replacements had hit highs back in December 2021, fallen to lows in the summer / autumn of 2022 but now are showing signs of reasonable longer term recovery, so have been added to the portfolio.

Thinking of this month, Fidelity FAST is looking like breaking my rules sufficiently to be on the danger list for replacement, so time to be looking around for a replacement if needed.

Current portfolio now consists of:-

Artemis Strategic Assets Fund

BlackRock Global Unconstrained Equity

Comgest Growth Europe ex UK

Fidelity Active Strategy FAST Global Fund

Fidelity Funds – Global Industrials Fund

Franklin India Fund

Fundsmith Equity

Invesco Global Focus Fund

JupiterMerian Global Equity Absolute Return Fund

Man GLG Japan CoreAlpha Equity Fund

Polar Capital Funds PLC – Polar Capital European Ex UK Income Fund

Polar Capital Funds PLC – Polar Capital Global Insurance Fund

I had always though of unit trusts / OEICs as being relatively slow moving, so have been mildly surprised at how much trading has been happening, a couple of sells in May and three in June. However this is what learning is all about, finding what works and what doesn’t. So I shall stick with my ideas of getting out of an investment when it starts heading below its 200 day moving average. I’d rather be safely out of something that shows signs of seriously falling as opposed to sticking with it hoping that it may recover, especially when there are other funds to be invested in that show a greater potential for gain.

Leave a comment