Two sells earlier on in the month, Bearings Global Agriculture and BNY Mellon US Equity Income. By the end of May Bearings has fallen nearly 7% and Mellon down by nearly 3%. Bearings sold because it was in a general ‘fall’ situation, and the Mellon US because of the uncertainty over the US debt situation. Two out meant two new arrivals, Artemis Strategic Assets and Polar Capital European ex-UK.

Overall, for May, the portfolio is down 2.4% while the FTSE All World index is down 1.2%. A bit of a disappointment as my target is to beat this index, however, not every month is going to be wizardly wonderful. So long as I can maintain a long term two steps forward for each step backward, then I’ll be happy.

So allowing for the two sells, what else pulled the portfolio down? The biggest offenders for May, Barings Global Resources and Guinness Global energy, both falling a little over 6% through the month (so maybe we could see some sells in June).

Speaking of which, it’s time to sort out some proper guidelines for when to sell. Too often I’ve let things run, thinking / assuming that some fall is only transitory and things will get better, and of course, they don’t. Then when I eventually get round to selling it’s at a far greater loss that it should be, which in turn takes so much longer to get back to where I was. Yes, there will be lots of times where the day after you sell they promptly jump back up, but that’s just life. If you see them coming back into positive territory again you can always buy back in.

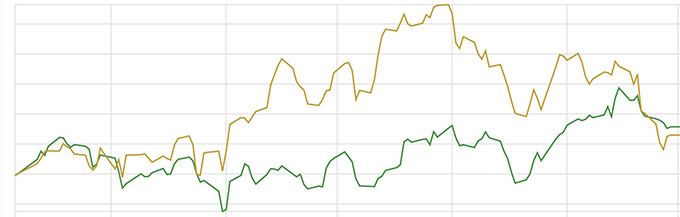

So a few ‘when to sell’ thoughts. (A reminder that this is not a buy and hold forever type portfolio, but one where I’m happy enough to jump in and out of when my mood takes me.) Using weekly charts, I’m going to keep an eye on the 10, 20 week and 30 week (200day) moving averages, paying attention to when the 10 week falls through the 20 week MA, and especially when funds fall below their 30 week moving average for two consecutive weeks. I think breaking down through the 30 week average really will be the ‘sell now’ cut-off factor. We’ll just have to see how this goes.

Leave a comment