So how did things do for the first month. OK, so not a complete month as it did begin at the start of the new tax year, but never mind.

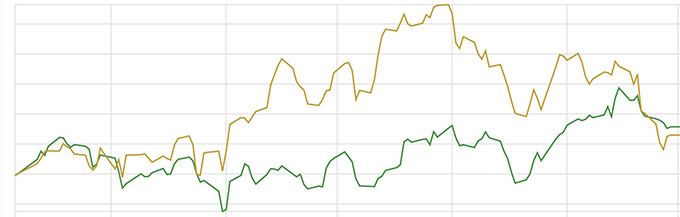

Investments were up 1.5% against the FTSE All World index increase of 1.4%. So an ever so slight improvement over the All World index, but not enough to make a big fuss over. I’m just happy enough that my portfolio has not significantly under-performed it.

So, what happened during the month. There was one transaction, Blackrock US Oppertunities was replaced with Fundsmith Equity. It’s not that the Blackrock fund was performing that badly, but I just prefered to have the investments in Fundsmith. This (Fundsmith) is perhaps the fund I’d go for if I was only to have one investment. Not a fund that going to ever rocket up, but something that should survive far better than most others doring periods of downturn / recession.

As for the coming month, Barings Global Agriculture Fund could be on the chopping block and replaced with something more interesting. I’m sure in the long term it will perform perfectly adequately, however I’m running this in more of a short / medium term time scale, so quite happy to swap in and out of things as my mood takes me.

I see around one quarter of the investments are classed as Commodities and Natural Resources, and if looked at on a regional basis, nearly half being North America.

Leave a comment