Start of a new tax year (April 2023) so a look to some investments I keep an eye on for my long term financial health.

This will be a virtual portfolio, however the activities will be based on the transactions I carry out as part of my (real) pension pot.

These are all unit trust / OEIC investments. I’m not a buy-and-hold-forever type, so trading will be carried out as my mood takes me.

The 12 currently held cover a diverse range of areas, so a bit of spreading the risk:-

Barings Global Agriculture Fund

Barings Global Resources Fund

Blackrock US Opportunities Fund

BNY Mellon US Equity Fund

Fidelity FAST Global Fund

Fidelity Global Industries Fund

Franklin India Fund

Guinness Global Energy Fund

JupiterMerian Global Equity Fund

L&G Global Health & Pharmaceuticals Fund

Man GLG Japan CoreAlpha Equity Fund

Polar Capital Global Insurance Fund

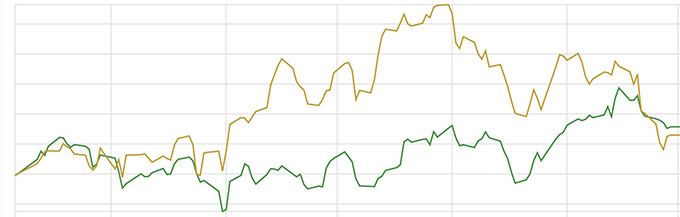

Assuming I can be motivated(!) then perhaps a monthly update. My task is to try and outperform the FTSE All world Index, which is an index that measures the market performance of around 3900 large- and mid-size companies located around the world.

Leave a comment